The Single Strategy To Use For Baron Tax & Accounting

Table of ContentsThe Of Baron Tax & AccountingFascination About Baron Tax & AccountingIndicators on Baron Tax & Accounting You Should KnowRumored Buzz on Baron Tax & AccountingHow Baron Tax & Accounting can Save You Time, Stress, and Money.

And also, accountants are expected to have a good understanding of maths and have some experience in an administrative role. To become an accounting professional, you have to contend the very least a bachelor's level or, for a higher level of authority and expertise, you can come to be a public accounting professional. Accountants should additionally satisfy the rigorous demands of the accounting code of practice.

This makes certain Australian company proprietors obtain the best feasible monetary recommendations and administration possible. Throughout this blog site, we have actually highlighted the huge distinctions between accountants and accountants, from training, to duties within your business.

The Ultimate Guide To Baron Tax & Accounting

The solutions they provide can make best use of earnings and sustain your funds. Businesses and individuals need to think about accountants an essential aspect of economic planning. No audit firm offers every solution, so guarantee your experts are best fit to your specific needs.

(https://www.intensedebate.com/people/baronaccountin)

Accountants exist to calculate and upgrade the set amount of cash every employee gets regularly. Bear in mind that holidays and illness affect pay-roll, so it's a component of business that you need to continuously upgrade. Retired life is likewise a considerable element of pay-roll administration, specifically considered that not every employee will intend to be enlisted or be eligible for your firm's retirement matching.

Some Known Questions About Baron Tax & Accounting.

.png)

Some lenders and investors require decisive, calculated decisions between the service and investors complying with the conference. Accounting professionals can likewise exist below to assist in the decision-making procedure. Preparation requires issuing the earnings, cash circulation, and equity declarations to examine your current economic standing and condition. It's very easy to see just how complex accountancy can be by the number of abilities and tasks required in the role.

Little organizations often deal with one-of-a-kind economic obstacles, which is where accounting professionals can give vital support. Accounting professionals offer a variety of services that help organizations stay on top of their financial resources and make educated decisions. easy online tax return service.

Accounting professionals guarantee that workers are paid precisely and on check here time. They calculate payroll taxes, take care of withholdings, and ensure compliance with governmental laws. Handling incomes Handling tax filings and repayments Tracking worker benefits and deductions Preparing payroll reports Proper payroll monitoring stops problems such as late repayments, incorrect tax filings, and non-compliance with labor laws.

7 Easy Facts About Baron Tax & Accounting Described

This step decreases the danger of errors and possible penalties. Local business owners can rely upon their accountants to take care of intricate tax codes and regulations, making the declaring process smoother and extra efficient. Tax preparation is one more vital service supplied by accounting professionals. Efficient tax preparation entails planning throughout the year to decrease tax obligation obligations.

These solutions commonly concentrate on organization valuation, budgeting and forecasting, and capital administration. Accountants help small companies in determining the well worth of the firm. They assess assets, obligations, profits, and market conditions. Techniques like,, and are used. Accurate evaluation assists with selling the business, safeguarding loans, or bring in capitalists.

Guide organization proprietors on best practices. Audit assistance assists services go through audits efficiently and successfully. It decreases stress and anxiety and mistakes, making sure that businesses satisfy all needed guidelines.

By establishing realistic monetary targets, businesses can allocate sources efficiently. Accounting professionals overview in the execution of these strategies to ensure they straighten with the company's vision.

Some Of Baron Tax & Accounting

They aid in establishing up inner controls to stop fraud and mistakes. In addition, accounting professionals encourage on compliance with legal and regulative requirements. They guarantee that services comply with tax laws and industry policies to prevent charges. Accountants also advise insurance policy policies that offer protection versus possible dangers, guaranteeing the service is safeguarded versus unexpected events.

These tools aid little organizations keep accurate records and enhance processes. It assists with invoicing, pay-roll, and tax prep work. It offers several attributes at no cost and is appropriate for startups and tiny services.

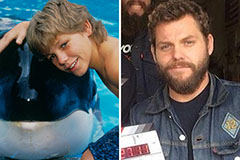

Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Christina Ricci Then & Now!

Christina Ricci Then & Now! Raquel Welch Then & Now!

Raquel Welch Then & Now! Mary Beth McDonough Then & Now!

Mary Beth McDonough Then & Now! Morgan Fairchild Then & Now!

Morgan Fairchild Then & Now!